Not just a house, but a home.

Not all Habitat homes look alike, and we do not sacrifice quality through the volunteer building process. Greater Lynchburg Habitat for Humanity builds homes that integrate with the architectural integrity of neighborhoods, promotes and requires quality construction practices, and hires construction professionals that supervise and coordinate builds with skilled and qualified crew members.

A typical GLHFH home is just under 1,200 square feet with three bedrooms and two bathrooms, but the actual size and number of bedrooms depends on family size. GLHFH is dedicated to construction practices that focus on quality. All homes are built to meet state and federal building codes. The homes appreciate in value and the average GLHFH house appraises in the range of $120,000 to $145,000 upon completion.

Qualifications Process

Greater Lynchburg Habitat for Humanity accepts applications during stated enrollment periods. While applications are always available upon request, they are also distributed at official Application Meetings, typically scheduled two or three times a year. Call Greg Tyree, Family Services Manager, at 434.528.3774, or email him for details. Greater Lynchburg Habitat for Humanity assesses families on the three following qualification criteria.

1) NEED

Families will be considered for a Habitat for Humanity house if their present housing is not adequate (i.e. proven cost-burden, unsafe or unhealthy, too crowded, etc.), and if they are unable to obtain adequate housing through conventional means.

Lack of adequate housing may include problems with the present structure, such as inadequate water, electrical or sewage service systems, heating system, or failure to meet city property maintenance standards. The number, ages and gender of the children compared to the number of bedrooms in your present home are taken into consideration.

We also consider the percentage of the family’s monthly income that is currently spent on housing. Families are required to be open and transparent, and must completely disclose their financial situation with the Family Services Manager.

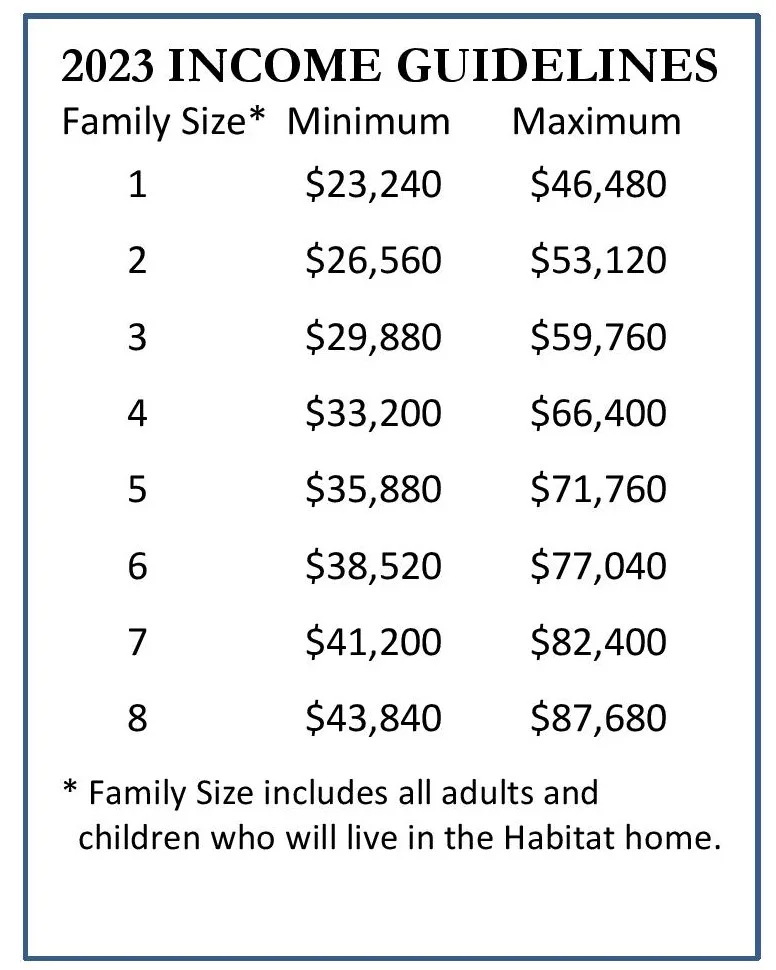

Applicants must currently live in the city of Lynchburg and have done so for a minimum of one year. Applications from outside of Lynchburg city are accepted at the discretion of the Board of Directors. Your application will be considered if your family’s total income is no less than 40% of the Lynchburg area median income (as determined by HUD). The maximum may not exceed 70% of the median income.

For additional information regarding income, please contact Greg Tyree, Family Services Manager, at 434.528.3774, or email him for details.

2) ABILITY TO PAY

Since families actually buy their home from Greater Lynchburg Habitat for Humanity, they must demonstrate their ability to pay the monthly mortgage payment. The best qualified applicants will have a credit score of at least 620 and a total debt-to-income ratio of less than 32%. A Habitat “house payment” includes principal (what was borrowed from Habitat), plus real estate taxes and homeowners insurance (placed in escrow). See current HUD income guidelines below.

First, ask yourself these questions:

- Do I have enough income based on Habitat’s guidelines to pay the modest house payment for the 20 to 30 year payment period?

- Are my expenses, in addition to a potential house payment, manageable within my income?

- Is my credit in reasonable shape (620 or above)?

All applicants must have an acceptable credit history and minimal outstanding debt. Bankruptcy, foreclosure, judgments and collections, unpaid medical bills, and outstanding student loans are considered when analyzing your credit.

3) WILLINGNESS TO PARTNER

If selected, your family will work toward becoming a partner family with Greater Lynchburg Habitat for Humanity (GLHFH). To become a partner family, you must complete 200 to 300 hours of volunteer work, or “sweat equity,” working on your house and the houses of others. These hours must be completed before you can become a homeowner.

Sweat equity might include clearing the lot, painting, helping with construction, or working at the GLHFH office or ReStore. As a partner family, you must complete half of the hours yourself. Members of the community, friends, and family may assist you in completing the remaining half. As a sign of good faith and in keeping with Habitat for Humanity’s mission of bringing all of God’s people together in partnership to build decent housing, at least 35 to 50 hours are to be spent working on the house of another family.

The prospective homeowner (PHO) will sign a letter of intent and relationship agreement with GLHFH.

The PHO will attend no less than six (6) homeowner classes (up to 12 classes), some with multiple sessions, from the time of acceptance until the closing of the home.

To maintain status as a Partner Family, you must keep your credit in good condition, not take on any other debts, and periodically provide proof of income. The Family Services Manager and your Family Advocate (assigned to you by the Family Services Committee) will assist in you being successful as a Partner Family.

Apply for a Home

Interested in applying for a Habitat Home?

We’d be happy to talk to you about our application process!